Aligning the “Other 95%” to Your Mission

Aligning the “Other 95%” to Your Mission

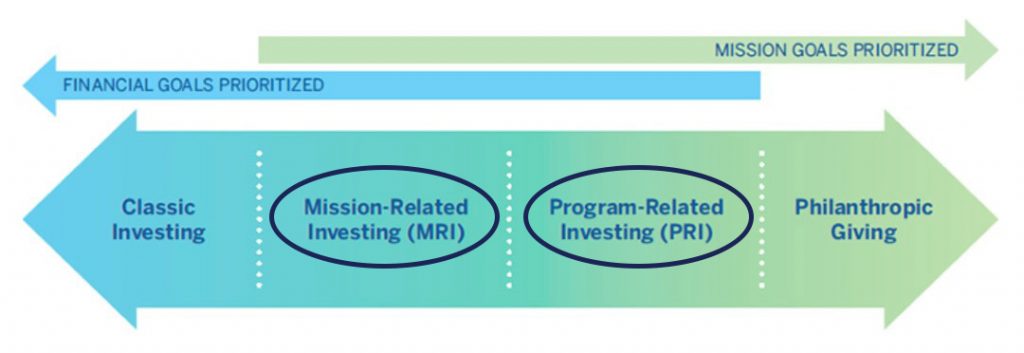

Mission investing is gaining in popularity with private foundations and public charities. This alternative investment approach allows foundations and charities to invest their corpus (the “Other 95%”) in ways that better align with their tax-exempt purpose. With the ability to have more “local impact”, mission investing is redefining ways to multiply philanthropic impact.

“The DeHoff Family Foundation has participated in two MRIs to date. It is extremely rewarding to align significant portions of our foundation’s investments with high impact projects in our community.” – Robert DeHoff, Chairman

- In 2013, 87,000 U.S. foundations collectively held about $800 billion in endowments. Such foundations annually spend at least 5% of their endowments, typically on grants and support costs to benefit their charitable missions—funding that totaled a minimum of $40 billion in 2013.

- However, few foundations actually go further and use social impact investing tools—such as Program-Related Investment (PRI) and Mission-Related Investment (MRI)—to advance their charitable missions beyond grant making.

- PRIs/MRIs have the potential to not only further the mission of a foundation, but also unlock additional financing for social initiatives. Yet, while many foundations have explored opportunities to leverage PRIs/MRIs to further their missions, the level of such outlays is surprisingly small, comprising less than 2% of private foundation endowments. Why? A number of barriers exist that prevent the broad use of such social investing tools.

Impact Development Company was formed to help more foundations overcome these barriers and leverage MRIs & PRIs to better align their investments with their purpose and maximize their charitable impact.

Case Study – the DeHoff Family Foundation and Canton Regional Chamber of Commerce Foundation invested locally to help bring great companies and great paying jobs to the Mills Business Park in Canton, Ohio.

Case Study – Six foundations pooled their resources to invest locally to develop the Stark Farms in Navarre, Ohio.

Case Study – Foundations historically use only 5-10% of their assets each year to advance their missions. The ”other 90-95%” of assets is invested through traditional means. Learn how Sorenson Impact Foundation decided to use 100% of their assets every year to accomplish their mission.

Case Study – the Venn Foundation unleashes the full power of Program-Related Investments (PRIs) to advance charitable impact in Minnesota, and beyond.

For more information regarding Mission Investing, please visit our Resources page.