- A PRI can be counted, along with grants and program support costs, towards the 5% minimum payout required for private foundations annually. The returns on the investment, in the year they materialize, are added to the 5% minimum payout requirement for that year, which serves to recycle the philanthropic capital.

- What’s more, there is no limit on the actual return on a particular investment, as long as charitable purpose is the primary consideration when making such investment. There are no prescribed limits on the size of the investment, the type of investment vehicle or the type of enterprise receiving the investment.

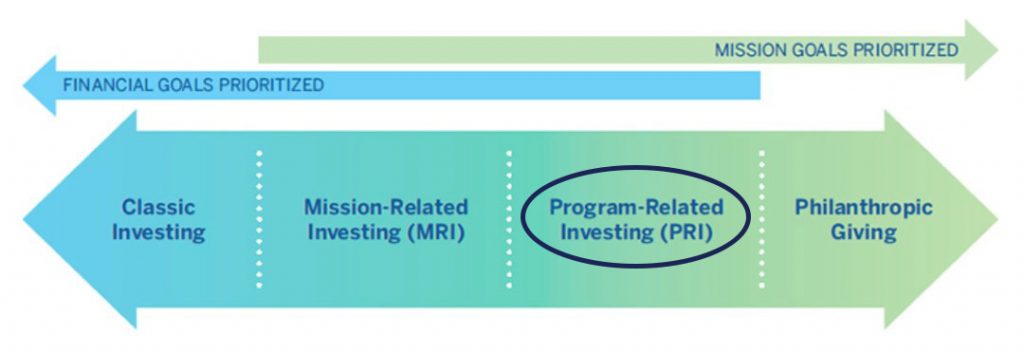

Case Study – the Venn Foundation unleashes the full power of Program-Related Investments (PRIs) to advance charitable impact in Minnesota, and beyond.

For more information regarding PRIs, please visit our Resources page.