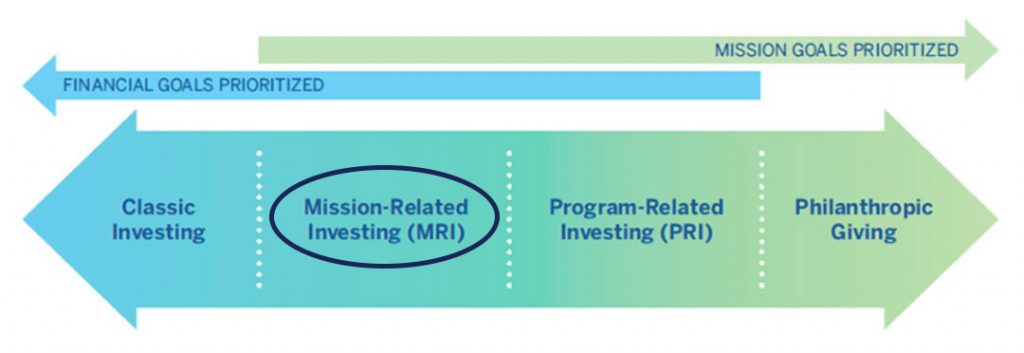

- An MRI both furthers the philanthropic mission of the foundation AND seeks to generate a competitive rate of return. Similar to a PRI, an MRI can be made in any asset class; however, since it is not designed to meet the IRS requirements to qualify as a PRI, the MRI will not count towards the foundation’s annual 5% payout requirement. MRIs have been little used to date, in part due to fear of violating “jeopardizing investment” laws, which require foundation managers and directors to avoid investments “that show a lack of reasonable business care and prudence in providing for the long- and short-term financial needs of the foundation.”

- In 2015, the IRS clarified the rules by indicating that it is not a jeopardizing investment just because foundation managers consider social impact consistent with the foundation’s mission when making the investment. They “are not required to select only investments that offer the highest rates of return, the lowest risks, or the greatest liquidity so long as foundation managers exercise the requisite ordinary business care and prudence under the facts and circumstances prevailing at the time of the investment in making investment decisions that support, and do not jeopardize, the furtherance of the private foundations charitable purposes.”

Case Study – the DeHoff Family Foundation and Canton Regional Chamber of Commerce Foundation invested locally to help bring great companies and great paying jobs to the Mills Business Park in Canton, Ohio.

Case Study – Six foundations pooled their resources to invest locally to develop the Stark Farms.

Case Study – Foundations historically use only 5-10% of their assets each year to advance their missions. The ”other 90-95%” of assets is invested through traditional means. Learn how Sorenson Impact Foundation decided to use 100% of their assets every year to accomplish their mission.

For more information regarding MRI’s please visit our Resources page.